The public sector faces unprecedented financial complexity. Government organizations struggle with outdated systems daily. Kendall Cartwright at DebtBook changes that narrative entirely.

As Director, Product at DebtBook, she’s revolutionizing how municipalities manage finances. Her leadership transforms clunky spreadsheets into intelligent systems. This isn’t just incremental improvement—it’s complete government finance modernization.

Introduction: Kendall Cartwright and DebtBook’s Vision

Who Is Kendall Cartwright?

Kendall Cartwright brings razor-sharp focus to product development. Her expertise spans financial technology (FinTech) and user experience. She understands government accountants face unique challenges daily.

Her background combines technical mastery with empathy. She doesn’t just build features. She solves real problems for finance professionals.

At DebtBook, Cartwright leads teams building next-generation finance tools. Her vision? Make compliance effortless, not painful. Transform treasury management software from burden to breakthrough.

Understanding DebtBook’s Core Mission

DebtBook emerged from frustration with existing solutions. Traditional accounting software for government was clunky. Manual processes consumed countless hours unnecessarily.

The company aimed higher. They envisioned cloud-based financial software that actually worked. Software designed for government, not adapted from private sector tools.

Their mission: deliver operational efficiency in finance through intelligent automation. Replace spreadsheet chaos with systematic clarity. Give finance officers time back.

Why Kendall Cartwright’s Leadership Matters Now

Digital transformation in finance accelerates constantly. New regulations emerge regularly. GASB 87 compliance and GASB 96 standards demand attention.

Government finance departments can’t keep up alone. They need technology leadership in finance. Someone who anticipates problems before they explode.

Cartwright provides exactly that. Her product leadership philosophy centers on proactive solutions. She builds tools that adapt to change seamlessly.

DebtBook: Revolutionizing Public Sector Financial Management

The Public Finance Software Landscape Before DebtBook

Picture this: Finance officers drowning in spreadsheets. Hours spent on manual data entry. Audit season causing organizational panic attacks.

Government accounting traditionally relied on disconnected systems. Data lived in silos. Financial reporting automation? Practically nonexistent.

Compliance became guesswork. Officers crossed fingers during audits. Transparency and accountability in finance suffered tremendously.

DebtBook’s Innovative Platform Overview

DebtBook flipped the script completely. Their cloud-based accounting solutions centralize everything. Debt and lease management tools integrate seamlessly.

Key Platform Features:

- Real-time debt portfolio tracking

- Automated compliance calculations

- Collaborative workspaces for teams

- Comprehensive audit trail generation

- Advanced scenario planning capabilities

The platform operates as SaaS for public finance. No complicated installations. No expensive hardware requirements. Just reliable, accessible financial management.

Key Features That Set DebtBook Apart

What makes DebtBook different? User-friendly finance platforms that government staff actually enjoy using. Revolutionary concept, right?

Financial compliance software typically feels punishing. DebtBook makes it intuitive. The interface anticipates user needs brilliantly.

Innovation in accounting systems shines through everywhere. Automated workflows eliminate repetitive tasks. Financial operations automation happens behind the scenes.

Comparative Advantages Table:

| Traditional Systems | DebtBook Platform |

| Manual data entry | Automated data sync |

| Spreadsheet-based | Centralized database |

| Limited reporting | Dynamic dashboards |

| Compliance anxiety | Built-in standards |

| Siloed information | Unified visibility |

Kendall Cartwright’s Role: A Leader in Product Development

Defining Product Leadership at DebtBook

Cartwright doesn’t just manage products. She orchestrates public finance innovation across teams. Her role demands both strategic vision and tactical execution.

She bridges technical teams and customer needs. Engineers build what she designs. Clients benefit from her deep understanding.

Her leadership style emphasizes collaboration. Cross-functional teams work together seamlessly. Strategic financial planning tools emerge from collective intelligence.

Vision-Driven Product Strategy

How does Cartwright identify market needs? She listens intently to finance professionals. Their pain points become her priorities.

Client feedback loops directly into development. Features aren’t theoretical—they’re practical. Efficiency in finance departments drives every decision.

She balances innovation with usability carefully. Cutting-edge technology means nothing if unusable. Data-driven financial management requires accessible interfaces.

Building a Culture of Innovation

Cartwright cultivates innovation systematically. Teams feel empowered to experiment. Failure becomes learning, not punishment.

Research and development receives strong investment. The best financial management tools require continuous improvement. Standing still means falling behind.

Software for government organizations evolves constantly. New regulations emerge. Technology advances. Cartwright ensures DebtBook stays ahead.

Key Contributions: Enhancing DebtBook’s Offerings

Product Feature Innovations Under Cartwright’s Leadership

Under her guidance, DebtBook rolled out transformative features. Subscription management software capabilities expanded dramatically. Audit automation systems simplified previously tedious processes.

She championed mobile accessibility initiatives. Finance officers work everywhere now. Remote capabilities became essential, not optional.

Financial data transparency improved through enhanced reporting. Stakeholders access information instantly. Trust increases when data flows freely.

GASB Compliance Automation Advancements

GASB 87 compliance terrified many organizations initially. Lease accounting standards seemed impossibly complex. Cartwright’s team made it manageable.

DebtBook automated calculation processes entirely. The software interprets standards correctly. Finance officers configure once, then trust.

Accounting regulations and compliance continue evolving. GASB 96 standards for subscriptions arrived next. DebtBook adapted seamlessly because Cartwright planned ahead.

Compliance Feature Benefits:

- Eliminates manual calculation errors

- Updates automatically with standard changes

- Generates required disclosure reports instantly

- Provides audit-ready documentation automatically

- Reduces compliance preparation time by 75%

Integration Capabilities Expansion

Modern governments use multiple systems simultaneously. Enterprise resource management requires connectivity everywhere. Cartwright prioritized integration capabilities heavily.

API development accelerated under her leadership. Third-party connections became simple. Data flows between systems automatically.

Cloud-based accounting solutions work best when connected. Finance departments need unified visibility. Cartwright delivered exactly that reality.

Impact on Clients: Streamlining Operations and Ensuring Compliance

Time Savings and Efficiency Gains

The numbers tell compelling stories. Clients report 60-80% time reductions. Tasks taking days now complete in hours.

One municipal client saved 500 hours annually. That’s real capacity for strategic work. Operational efficiency in finance translates to better service delivery.

Nonprofit finance management sees similar gains. Limited staff accomplish more. Resources stretch further than before.

Enhanced Accuracy and Risk Reduction

Manual processes invite errors inevitably. DebtBook’s automation eliminates human mistakes. Calculations happen correctly every single time.

Financial reporting automation ensures consistency. Reports match across departments. Discrepancies disappear completely.

Audit readiness becomes standard practice. Finance teams approach audits confidently. Compliance reporting automation makes preparation painless.

Client Success Stories

A mid-sized city transformed operations completely. They managed $200 million in debt previously through spreadsheets. Now? Centralized visibility and control.

A state agency handling nonprofit financial reporting cut preparation time dramatically. What took three weeks now requires three days.

Public sector financial technology delivers measurable value. These aren’t theoretical benefits—they’re documented outcomes.

The Future of Public Finance with DebtBook and Its Leadership

Emerging Trends in Public Finance Technology

Artificial intelligence enters public sector finance increasingly. Predictive analytics will transform decision-making. Cartwright positions DebtBook at this frontier.

Machine learning could automate anomaly detection. Identify issues before they become problems. Innovation in accounting systems accelerates constantly.

Public finance modernization demands continuous adaptation. Organizations embracing technology thrive. Those resisting face growing struggles.

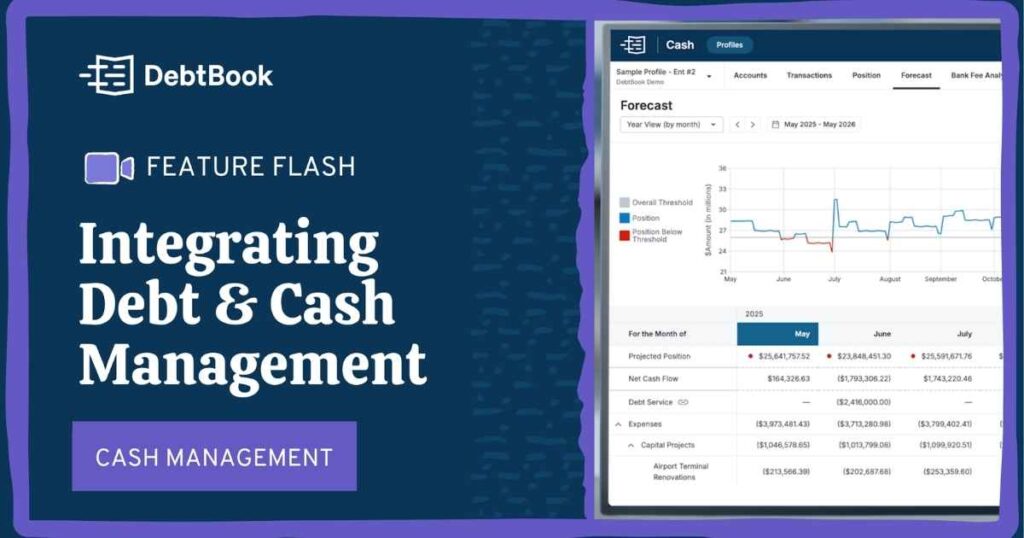

DebtBook’s Product Roadmap Vision

Cartwright envisions expanded capabilities coming soon. Enhanced forecasting tools. Deeper analytics. More intelligent automation everywhere.

The platform will anticipate user needs proactively. Suggest optimizations automatically. Strategic financial planning tools become truly intelligent.

Technology leadership in finance requires bold vision. Cartwright provides exactly that. Her roadmap addresses tomorrow’s challenges today.

Frequently Asked Questions

What is Kendall Cartwright’s role at DebtBook?

Kendall Cartwright serves as Director of Product at DebtBook, leading product development strategy and innovation for their public finance software platform.

How does DebtBook help with GASB compliance?

DebtBook automates GASB 87 and GASB 96 compliance through built-in calculations, automated reporting, and real-time updates that eliminate manual processes entirely.

What makes DebtBook different from traditional government accounting software?

DebtBook offers cloud-based, user-friendly financial management tools specifically designed for public sector needs, providing automated compliance, real-time collaboration, and comprehensive debt management.

Who benefits most from using DebtBook’s platform?

Municipal governments, state agencies, educational institutions, nonprofits, and special districts managing debt portfolios benefit from DebtBook’s streamlined financial operations and compliance automation.

How has Kendall Cartwright driven innovation in public finance technology?

Cartwright has led the development of automated compliance features, enhanced integration capabilities, improved user experience design, and strategic product roadmaps that anticipate regulatory changes.

Conclusion: A Testament to Innovation and Expertise

Summarizing Kendall Cartwright’s Impact at DebtBook

Kendall Cartwright proves one leader changes everything. Her product leadership elevated DebtBook significantly. Public finance software finally serves its users properly.

She transformed abstract technology into practical solutions. Government finance officers work smarter now. Transparency and accountability in finance improved dramatically.

Her contributions extend beyond features. She cultivated innovation culture company-wide. Teams build remarkable financial management tools because she empowers them.

The Lasting Legacy of Product-Driven Leadership

Cartwright’s influence ripples throughout government accounting. Other organizations notice DebtBook’s success. They demand similar capabilities elsewhere.

She’s raising industry standards permanently. User-friendly finance platforms become expectations, not exceptions. The entire public finance innovation landscape shifts.

Future leaders will study her approach. How did she balance technical excellence with usability? How did she maintain vision while delivering constantly?

Government finance modernization needed exactly this catalyst. Kendall Cartwright at DebtBook provided it. The public sector benefits tremendously as a result.